Recognizing the Fundamentals of Cryptocurrencies for Beginners

The landscape of cryptocurrencies provides a facility yet fascinating chance for newcomers to the economic globe. Understanding what cryptocurrencies are, just how blockchain innovation underpins their operation, and the various kinds readily available is essential for enlightened participation. Additionally, comprehending the importance of electronic wallets and recognizing the linked threats and advantages can considerably influence one's method to investing in this swiftly evolving room. As we explore these foundational components, one must take into consideration: what are the critical factors that can affect both the security and volatility of this market?

What Are Cryptocurrencies?

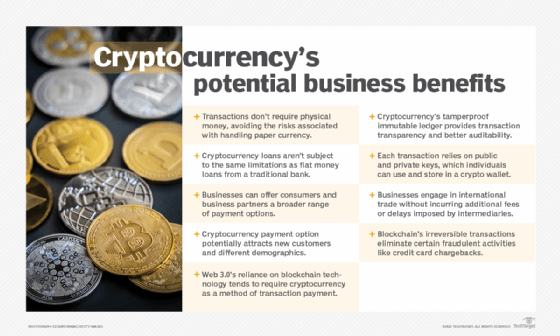

Although the principle of currency has developed substantially over time, cryptocurrencies stand for a cutting edge shift in just how worth is exchanged and stored (order cryptocurrencies). Specified as digital or digital money that make use of cryptography for security, cryptocurrencies operate independently of a main authority, such as a government or financial institution. This decentralization is a key characteristic that distinguishes them from traditional fiat money

Cryptocurrencies feature on a modern technology called blockchain, which makes sure transparency and safety and security by tape-recording all transactions on a dispersed journal. This technology enables peer-to-peer purchases without the demand for middlemans, lowering purchase prices and increasing effectiveness. Bitcoin, released in 2009, was the first copyright and stays one of the most acknowledged; nonetheless, countless alternatives, known as altcoins, have given that arised, each with special features and utilize situations.

The appeal of cryptocurrencies hinges on their potential for high returns, privacy, and the capacity to bypass standard banking systems. However, they come with integral dangers, including rate volatility and governing uncertainties. As cryptocurrencies proceed to get grip, recognizing their fundamental nature is necessary for any person aiming to engage with this transformative financial landscape.

Just How Blockchain Modern Technology Functions

The decentralized nature of blockchain indicates that no solitary entity has control over the entire journal. Instead, every participant in the network holds a copy, which is constantly updated as new transactions occur. This redundancy not just boosts protection yet also promotes openness, as all individuals can confirm the purchase background.

To verify deals, blockchain employs a consensus device, such as Evidence of Job or Proof of Risk, which calls for individuals to resolve intricate mathematical issues or verify their risk in the network. This process inhibits malicious tasks and keeps the honesty of the ledger. In general, blockchain technology represents an innovative strategy to information management, promoting trust fund and effectiveness in digital purchases without the requirement for middlemans.

Kinds Of Cryptocurrencies

Various kinds of cryptocurrencies exist why not try these out in the digital financial landscape, each offering distinct functions and capabilities. The most well-known category is Bitcoin, developed as a decentralized electronic money to facilitate peer-to-peer transactions. Its success has led the means for hundreds of different cryptocurrencies, frequently referred to as altcoins.

Altcoins can be classified right into several groups (order cryptocurrencies). There are stablecoins, such as Tether (USDT) and USD Coin (USDC), which are fixed to conventional money to minimize volatility. These are suitable for individuals seeking security in their electronic transactions

Another classification is utility symbols, like Ethereum (ETH) and Chainlink (LINK), which grant holders details civil liberties or access to solutions within a blockchain ecosystem. These tokens often sustain decentralized applications (copyright) and clever agreements.

Comprehending these sorts of cryptocurrencies is important for novices aiming to navigate the complicated electronic money market efficiently. Each type provides distinct functions that provide to different customer needs and investment methods.

Setting Up a Digital Wallet

Establishing a digital purse is a necessary action for any individual wanting to take part in the copyright market. An electronic budget works as a secure setting for keeping, sending, and getting cryptocurrencies. There official source are several sorts of purses readily available, including software application pocketbooks, hardware wallets, and paper purses, each with distinct functions and degrees of safety.

Software program pocketbooks, which can be desktop computer or mobile applications, offer ease and ease of use, making them suitable for regular deals. Hardware wallets, on the various other hand, offer boosted security by keeping your personal keys offline, making them ideal for long-term capitalists.

When you pick a pocketbook, download or acquisition it from a credible source and follow the setup directions. This typically involves developing a safe and secure password and backing up your recovery phrase, which is vital for recovering access to your funds. By taking these steps, you will certainly lay a strong structure for your copyright activities.

Threats and Advantages of Investing

Nevertheless, these advantages feature noteworthy risks. Market volatility is a you could try these out critical concern; copyright rates can change considerably within short durations, bring about possible losses. The absence of governing oversight can expose capitalists to illegal plans and market manipulation. Safety and security is an additional issue, as electronic wallets and exchanges are at risk to hacking, leading to the loss of properties.

Capitalists need to likewise know the technical complexities and the rapidly developing landscape of cryptocurrencies. Remaining educated and conducting extensive research study are vital to navigate these difficulties. In summary, while investing in cryptocurrencies supplies luring possibilities, it is imperative to consider these against the inherent risks to make educated choices. Comprehending both sides is crucial for any type of possible capitalist entering this dynamic market.

Final Thought

In final thought, a fundamental understanding of cryptocurrencies is essential for navigating the electronic economic landscape. Expertise of blockchain modern technology, the different kinds of cryptocurrencies, and the process of establishing up a digital wallet is critical for security.